Understanding Impulse Buying

Understanding Impulse Buying

Impulse buying is defined as the spontaneous and unplanned purchase driven by emotional responses rather than rational decision-making. This behavior is prevalent in online shopping environments, where consumers are often inundated with visual stimuli, promotions, and techniques that cater to their emotions. Various psychological triggers contribute to impulse buying, including stress, excitement, and the need for instant gratification. When shopping online, consumers may be drawn to limited-time offers or exclusive deals that create a sense of urgency, prompting them to make purchases they had not initially intended.

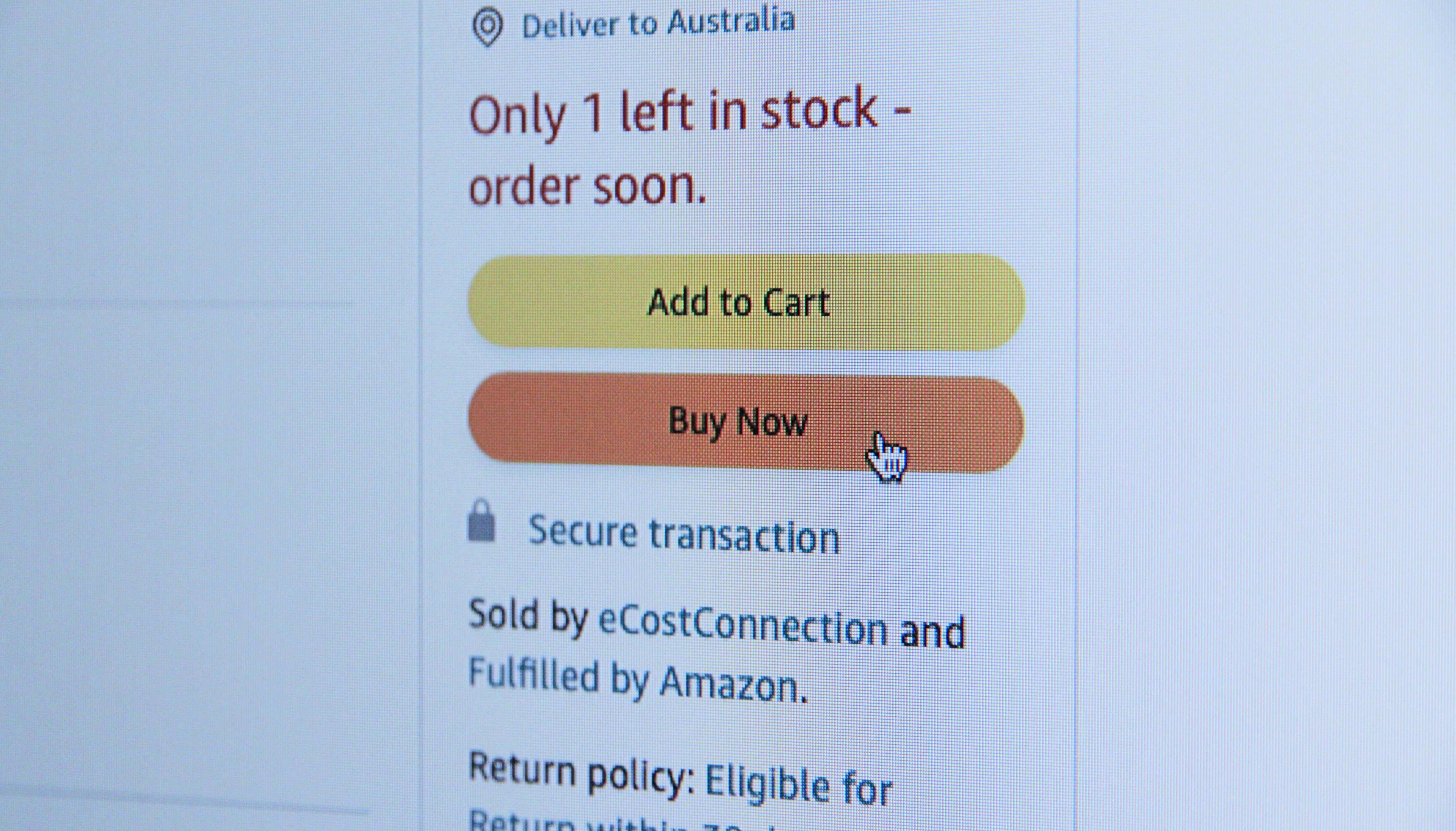

Additionally, situational factors, such as the ease of access to shopping platforms and the anonymity of the internet, can further exacerbate impulse buying behaviors. The online shopping environment often removes the typical barriers encountered in physical stores, such as queues or face-to-face interactions with sales staff. This convenience allows consumers to shop at any moment, making it easier to indulge in impulsive purchases without a second thought. Furthermore, the ability to quickly reorder previously purchased items with just a few clicks contributes to repeat impulse buying.

Environmental factors, such as site design and personalized marketing strategies, also play a significant role in shaping impulse buying tendencies. Retailers often utilize algorithms to recommend products based on past shopping behavior, which can lead to unexpected purchases. The presence of customer reviews, ratings, and social proof can enhance the desirability of items, further escalating the likelihood of impulsive buying decisions. In e-commerce, where product offerings are often curated to elicit excitement, it is essential to understand these stimuli to address impulse buying effectively. Recognizing the psychological and situational triggers behind these behaviors is crucial for consumers looking to master their spending habits.

Recognizing Your Triggers

Impulse buying during online shopping is often prompted by various psychological and emotional triggers. Understanding these triggers is essential for individuals looking to master their spending habits effectively. For many, emotional states such as stress, boredom, or anxiety play a significant role in generating impulsive purchasing decisions. When feeling overwhelmed or idle, consumers may turn to online shopping as a temporary escape, leading to unintended purchases that do not align with their financial goals.

Another crucial aspect contributing to impulse buying is specific shopping habits that individuals may have developed over time. For instance, some consumers might find themselves frequently browsing shopping websites during particular times of the day, such as late at night or during breaks at work. These habitual browsing sessions can easily transform into impulsive buying sprees when individuals encounter enticing products or promotions. By identifying these patterns, shoppers can take proactive measures to break the cycle of impulse spending.

Additionally, external prompts, such as flash sales, limited-time offers, and targeted advertisements, play a significant role in triggering urges to buy spontaneously. Online retailers often use psychological tactics to create urgency, making consumers feel compelled to make quick decisions before an opportunity disappears. Recognizing how these external cues affect spending behavior can help individuals discern when they are being influenced by marketing tactics rather than genuine need.

Through self-reflection and awareness, consumers can identify their unique triggers for impulse buying. Keeping a journal of shopping experiences and emotions surrounding purchases can provide valuable insights into patterns of behavior. By recognizing these triggers, individuals can develop strategies to mitigate impulsive buying and make historically informed shopping choices that align with their financial objectives.

The Importance of a Shopping List

In the realm of online shopping, the significance of creating a shopping list cannot be overstated. A well-constructed shopping list serves as a vital tool that helps consumers prioritize their needs and manage their spending effectively. By outlining what is genuinely required, individuals can avoid the allure of impulse purchases that often arise in the vast digital marketplace. When one enters an online store with a specific list, the likelihood of unwanted expenditures decreases significantly.

To compile a shopping list that reflects genuine needs, it is essential to evaluate items based on necessity rather than desire. Begin by reviewing your current inventory at home. This assessment helps identify what needs replenishment while discouraging the temptation of buying items that are already available. Additionally, consider establishing a timeframe for your list; for instance, weekly or monthly needs can help streamline the shopping experience and mitigate the impulse to overspend.

Another effective strategy for adhering to a shopping list involves setting a budget. Establish a monetary limit for each shopping trip, thus ensuring that spending aligns with financial capabilities. This practice not only aids in curbing impulse buying but also promotes mindful purchasing habits. Furthermore, employing technological aids can facilitate this process; several applications are designed to create lists and track spending, making it easier for consumers to remain within their defined parameters.

To reinforce commitment to the shopping list, it may be beneficial to pause before finalizing purchases. Taking a moment to reflect on whether each item aligns with your list can reduce the impulse to add unplanned products to the cart. By prioritizing a shopping list, consumers can master their spending habits, transforming online shopping from a perilous activity into a structured and intentional process.

Implementing a Waiting Period

One effective strategy to counteract impulse buying while online shopping is to impose a waiting period before making a purchase. This method encourages consumers to pause and reflect during their shopping experience, fostering a more thoughtful approach to spending. The concept is straightforward: before completing a transaction, a shopper commits to a 24-hour cooling-off period. This timeframe is generally long enough for an individual to consider whether the item is truly necessary or just an impulse buy.

During this waiting period, it can be helpful to engage in a few reflective practices. For instance, one might revisit the reasons why they wanted to purchase in the first place. Questions such as “Do I need this item?” or “How often will I use it?” can lead to critical evaluations of one’s shopping habits. Additionally, consumers can create a list of pros and cons, establishing clarity on whether the purchase aligns with their financial goals.

Shoppers who have successfully implemented this technique report notable benefits. For example, a frequent online shopper named Sarah found that giving herself 24 hours to think about a pair of expensive shoes led her to realize she hadn’t worn similar shoes in years. This simple pause saved her a significant amount of money and time, ultimately allowing her to redirect her spending towards experiences she values more, such as traveling.

Moreover, the waiting period can help to diminish the emotional triggers of impulsive purchases. Many people often shop to relieve stress or boredom, but by encouraging a delay, consumers can find healthier ways to cope with these feelings. Hence, this strategy not only discourages impulse buying but also empowers consumers to make informed and intentional purchasing decisions.

Utilizing Budgeting Tools and Apps

In the era of digital shopping, effective management of personal finances is more crucial than ever. Budgeting tools and apps offer a practical solution for individuals aiming to curb impulse buying while shopping online. These technological resources simplify the process of tracking expenses, setting limits, and observing spending behavior, creating a structured environment conducive to financially responsible online purchases.

One of the primary advantages of budgeting tools is their ability to establish specific spending limits tailored to the user’s financial situation. These tools often come equipped with user interfaces that allow individuals to set monthly or weekly budgets for various categories, including discretionary spending. By defining clear thresholds, shoppers can gain awareness of their financial boundaries, which significantly helps in resisting the temptation of impulse buying.

Additionally, many budgeting apps feature tracking options that provide users with real-time insights into their purchases. These functionalities enable individuals to monitor where their money goes, thus highlighting patterns and trends in their spending habits. With this information at hand, users can make informed decisions that align with their financial objectives. Not only does this data become instrumental in recognizing overspending triggers, but it also empowers individuals to adjust their online shopping strategies accordingly.

Moreover, some apps integrate alerts or notifications when users approach their budget limits. This proactive approach serves as a reminder to practice restraint, minimizing the risk of unplanned purchases and facilitating a more disciplined shopping experience. By leveraging these budgeting tools and apps, individuals can cultivate healthier online shopping behaviors, ultimately leading to improved financial wellness.

In conclusion, utilizing budgeting tools and apps offers a comprehensive way to enhance fiscal responsibility while navigating the online shopping landscape. By setting limits, tracking expenses, and analyzing spending trends, these resources play an essential role in combating impulse buying.

Enhancing Your Online Environment

Creating an online shopping experience that minimizes the temptation to impulse buy is essential for maintaining financial discipline. The first substantial step is to manage email subscriptions effectively. Many retailers send out promotional emails that can trigger unnecessary purchases. By unsubscribing from these newsletters, you reduce exposure to constant sales notifications. This decision will not only declutter your inbox but also help cultivate a mindset that prioritizes need over want.

Additionally, it is beneficial to follow brands selectively on social media platforms. Since social media can serve as a significant driver of impulse purchases, curating your feed to only include brands that align with your values and needs is vital. Unfollowing brands that you find to be particularly triggering can vastly decrease the likelihood of making spontaneous purchases. Engaging primarily with content that reflects your genuine interests and hobbies can create a more intentional online presence.

Furthermore, adjusting website notifications can significantly impact your shopping behavior. Many e-commerce platforms offer options to customize notifications regarding deals, new arrivals, or back-in-stock alerts. Taking control of these alerts—limiting them to essential updates—ensures that you are not inundated with information that can prompt impulsive decisions. By only enabling notifications that are pertinent to your shopping habits, you further establish boundaries that promote mindful spending.

Ultimately, creating an online shopping environment that minimizes distractions increases your ability to make thoughtful purchasing decisions. By implementing these strategies, you can enjoy a more focused, deliberate online experience, thereby reducing the risk of impulse buying and fostering better spending habits. This proactive approach not only curtails needless expenses but also supports long-term financial wellness.

The Role of Mindfulness and Personal Reflection

In the rapidly evolving landscape of online shopping, mindfulness plays a crucial role in promoting intentional purchasing behavior. Consumers often find themselves inundated with tempting deals and promotions, leading to impulsive buying without adequate consideration. By practicing mindfulness, shoppers can cultivate awareness of their feelings, environment, and the motivations driving their purchasing decisions. This heightened awareness can serve as a powerful tool to mitigate the effects of impulse buying.

One effective technique for enhancing mindfulness before a purchase is self-reflection. Shoppers are encouraged to ask themselves a series of probing questions before finalizing a transaction. For instance, individuals should consider whether the item in question is a genuine need or simply a fleeting desire sparked by an advertisement. Additionally, reflecting on past purchasing decisions can provide insight into patterns of behavior that contribute to impulse buying. This cyclical process of self-reflection not only aids in developing discipline but also promotes a deeper understanding of personal financial habits.

To further support the practice of mindfulness, individuals may benefit from journaling their shopping experiences. Keeping a detailed log of emotions before and after shopping sessions can highlight triggers that lead to unnecessary expenditures. Furthermore, the incorporation of mindfulness apps can be incredibly beneficial; many provide guided meditations and grounding exercises designed to foster emotional awareness and regulation during the shopping process. Such tools encourage consumers to pause and assess their feelings, especially during moments of temptation, ultimately leading to more informed purchasing decisions.

By cultivating mindfulness and engaging in personal reflection, individuals can create a more structured and responsible approach to online shopping. This methodology not only addresses the immediate urge to purchase impulsively but also contributes to long-term financial health and emotional well-being.

Seeking Support from Friends and Family

One effective strategy to curb impulse buying while online shopping is to seek support from friends and family. Social accountability plays a vital role in reinforcing commitment to responsible spending habits. When individuals share their financial goals and shopping behaviors with trusted individuals, they create a network of support that holds them accountable. This can be particularly beneficial in moments of temptation, where the allure of impulsive purchases might otherwise lead to unplanned expenses.

Establishing spending buddies or accountability partners is a proactive approach to managing online shopping habits. These companions can offer encouragement, share their own experiences with impulse buying, and help to identify triggers that lead to unplanned purchases. For example, if an individual finds themselves frequently shopping online during stressful moments, a spending buddy can suggest alternative, healthier coping mechanisms or accompany them in activities that distract from the urge to shop impulsively.

Moreover, engaging with friends or family members who also aim to improve their spending habits can foster a sense of community and shared purpose. Regular check-ins or group discussions about financial behaviors can be invaluable. These interactions not only strengthen relationships but also provide a platform for individuals to reflect on their spending patterns and make conscious decisions about their purchases. This support system can extend to brainstorming strategies for budget adherence, prioritizing needs over wants, and even sharing resourceful tips for cost-effective shopping.

Ultimately, the influence of friends and family can significantly impact one’s approach to financial health. By openly discussing shopping behaviors and seeking guidance when needed, individuals can empower themselves to make thoughtful decisions about their spending, thereby reducing the likelihood of impulse buying and enhancing their overall financial well-being.

Conclusion: Creating Lasting Changes

In the realm of online shopping, mastering spending habits is crucial for financial well-being. Throughout this blog post, we have explored several effective strategies to help individuals curb impulse buying tendencies. Each strategy not only aims to reduce unnecessary expenses but also fosters a greater understanding and control over one’s purchasing decisions.

One of the prominent strategies discussed involves establishing a budget. This provides a solid framework within which individuals can evaluate their financial limits and prioritize essential purchases. Similarly, the use of a shopping list can serve as a reminder of what is truly needed, minimizing the likelihood of spontaneous purchases. Additionally, implementing a waiting period before making purchases allows for reflection, helping to distinguish between wants and needs.

Moreover, self-awareness plays a critical role in overcoming impulse buying. By recognizing triggers—whether they be emotional, social, or environmental—individuals can take proactive steps to mitigate their impact. Techniques such as evaluating one’s motivations for shopping and practicing mindfulness help in making conscious choices rather than falling victim to impulsive decisions.

As we conclude this discussion on impulse buying, it is essential for readers to reflect on their own shopping behaviors and consider how the strategies presented can be integrated into their daily lives. Change does not occur overnight; rather, it is a gradual process that requires consistency and commitment. Encouraging oneself to continuously seek improvement in financial habits can lead to lasting change, ultimately transforming the way individuals approach online shopping.

By applying these principles diligently and embracing self-awareness, one can successfully navigate the world of online shopping without succumbing to the allure of impulse buying.

Understanding Impulse Buying

Understanding Impulse Buying